Written by Dr Veronica Broomes LLM, PhD (Sustainability & Low Carbon Advisor)

– This article introduces what sustainability means, its relevance to property investments and link between sustainability (multiple pillars) and property investments. An overview is given of how relevant facets of sustainability can be integrated into property investment decisions, either at the start or further along when making informed investment decisions.

Sustainability – what it means and why it matters

At its core sustainability describes the approach of considering environmental, social, economic and governance issues in decision-making by businesses. This is in contrast to the single bottom line approach of focusing only on financial factors in calculating Return on Investments (ROI). This shift has led lenders to require non-financial dimensions be factored into decision-making and for computing ROI. For example, asset managers in assessing risks of deploying funds from High Net Worth Individuals (HNWI) or pensions consider both numeric values (quantitative) and qualitative measures that have positive impacts on people and/or the natural environments.

Indeed, according to the International Sustainability Standards Board (ISSB) “…sustainability factors are becoming a mainstream part of investment decision-making. There are increasing calls for companies to provide high-quality, globally comparable information on sustainability-related risks and opportunities, …”.

Embedding sustainability can improve profits

Myths abound about sustainability. Some view it as a ‘nice to have’ ‘bolt-on” to traditional ways of assessing investments. Others think sustainability is about philanthropy or ‘giving back’, being ‘green’ and not of interest to lenders.

On the contrary, it is best when key pillars of sustainability form part of the business rationale in decision making. This enables investors and developers to show how financial savings are made, e..g, through reducing initial construction costs, introducing onsite generation and storage of renewable energy (e.g., solar or wind) or lowering maintenance costs. Investment projects in which sustainability is embedded have lower risks of becoming ‘stranded assets’ from high costs of ’embodied carbon’ and can benefit from retrofitting, reclamation, low carbon refurbishments or use of ‘eco-homes framework(s)’.

Sustainable property investing award 2023 -why applying can be a smart move

Being among the first to apply for the Sustainability Property Investing Award can be a smart move!

Not only can you bring an additional dimension in assessing ROI of recently completed property developments and share ‘eco-friendly’ criteria applied, but it is another opportunity to raise brand awareness, showcase actions that reduce carbon emissions, protect investments for the longer term, lower risk of stranded assets and/or increase positive social impacts for stakeholders. Moreover, upskilling traditional trades can contribute to future proofing employability as well as minimised delays in completing building investment projects.

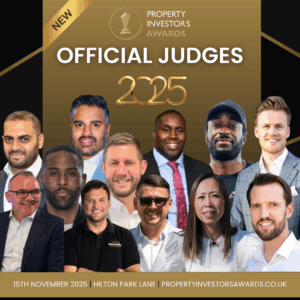

In introducing ‘Sustainability’ as a category in the 2023 Property Investors Awards (PIA), organisers took a timely and highly commendable action. This signals awareness of the changing investment landscape where climate change and social impacts form part of the criteria lenders apply in assessing risks and return on investments. Furthermore, focusing on carbon emissions (energy use, waste generation) implies a recognition that implications for property investments stretch beyond 2030 as the construction sector innovates in design and choice of building materials.

Can embedding sustainability in property investing deliver greater protection?

Property investors who demonstrate how their developments emit less carbon in construction/redevelopment through lower energy costs when occupied by end users will be viewed as having lower risks to lenders. This is of growing importance as larger organisations (as part of their legal obligations) report on Scope 3 emissions (derived from supply chains), confirm compliance with Modern Slavery legislation (e.g., jobs in construction, cleaning, maintenance) and evidence positive social impact (social value).

For Buy-to-let investors, purchasing energy inefficient properties that cannot be improved beyond cosmetic changes risks longer voids as they cannot compete with modern energy efficient properties in the private rental sector. In addition, the costs of improvements makes the inefficient property costly to maintain and become unattractive to lenders for re-mortgaging.

The three new sustainability categories that have been introduced to this years Property Investors Awards are:

- Sustainable Property Developer of the Year

- Sustainable Property Development of the Year (£1 million or below)

- Sustainable Property Development of the Year (above £1 million)

Click here to submit a nomination for the Property Investors Awards.

Veronica Broomes LLM, PhD

Sustainability Support for Business

Tel: 0114 551 3387 /0791 405 6154

Peak Homes Yorkshire Ltd

E: hello@peakhomesyorkshire.co.uk

https://www.linkedin.com/company/sustainability-support-for-business/

https://twitter.com/PeakYorkshire

Enquiries: https://peakhomesyorkshire.co.uk/contact/

2023 Sustainability Insights survey: https://bit.ly/3JaRcUh